Join our Newsletter receive 🎁

Luxury in a New Era: Key Findings from “The State of Fashion Luxury” Report.

The luxury goods industry is undergoing a significant transformation. After years of growth driven mainly by price increases rather than actual sales, brands need to adapt their strategies to the new reality. The State of Fashion Luxury report, produced by The Business of Fashion and McKinsey & Company, analyses the changes in consumer behaviour, the challenges facing the industry and the key strategies that could determine the success of luxury brands in the coming years. Translated with DeepL.com (free version)

Contents of the article

- Slowing growth - a luxury not for everyone?

- The new luxury consumer: increasingly aware and demanding

- Challenges for luxury brands

- Strategies for luxury in 2025

- Personalisation and exclusivity reinvented

- Supply chain optimisation and investment in quality

- New sales channels and loyalty strategy

- Expansion into new segments

- Regional differences in the luxury market

- Which luxury categories will survive the crisis?

- What will luxury of the future look like?

Slowing growth - a luxury not for everyone?

Over the years, the luxury sector has grown at a rate of around 5% per year (2019-2023), but in 2024 the growth rate slowed down significantly. Forecasts for 2025 show growth of only 1-3%. The increase in the value of the market in recent years has mainly been due to price increases rather than more customers. As a result, many brands have excluded a proportion of consumers aspiring to luxury goods, which may affect the long-term dynamics of the market.

Luxury brands that have built their value on prestige and price over the years will have to find new ways to maintain their position. Customers expect more than just a high price tag - they are looking for authenticity, unique experiences and values that align with their lifestyle.

The new luxury consumer: increasingly aware and demanding

Today's luxury brand customers are different from those of a decade ago. It is not only the product that is increasingly important, but also the overall brand experience. Consumers expect more personalisation, transparency and social engagement from brands.

Research shows that 80% of ultra-rich customers (UHNWI) are looking for new, niche brands rather than opting for the most well-known fashion houses. In contrast, 80% of high-net-worth customers (HNWI) say they want to spend a portion of their budget on experiences and wellness, rather than exclusively on luxury products. Customers are also paying more attention to sustainability and ethical practices, expecting brands to be more transparent about the origin of raw materials and production conditions.

Challenges for luxury brands

One of the key problems highlighted by the report is that luxury customer service does not always meet consumer expectations. Many complain that shopping in boutiques is no longer as exclusive as it once was - personalisation is lacking and staff are not always knowledgeable enough about the products.

Brands have to simultaneously cut costs while maintaining top quality and exclusivity, which is a major challenge. Competition is getting tougher, not only from the luxury giants, but also from smaller, niche brands that attract customers with their authenticity and individual approach.

Strategies for luxury in 2025

Experts point to several key strategies that can help luxury brands maintain their position in the market.

Personalisation and exclusivity reinvented

Brands should focus on creating unique experiences for their customers. Exclusive events, private collections, limited edition drops available only to loyal customers - these can all help to rebuild customer relationships and increase the sense of a unique shopping experience.

Supply chain optimisation and investment in quality

In the long term, investing in the long-term sustainability of production and maintaining high-quality craftsmanship will be crucial. This is exemplified by the strategy of Hermès, which consistently invests in traditional production techniques and premium raw materials, emphasising its heritage.

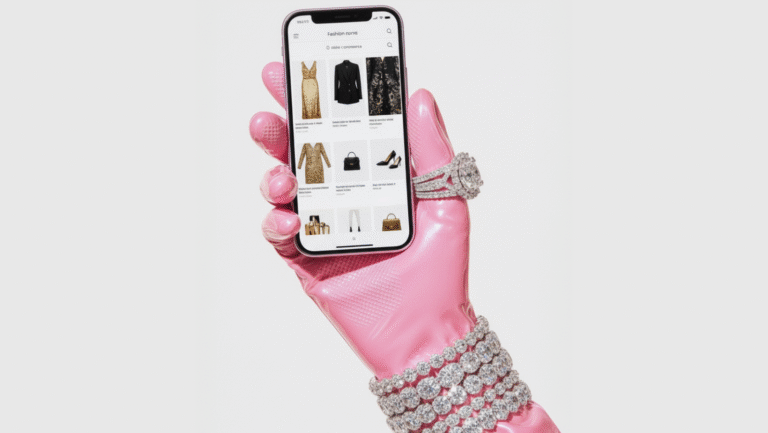

New sales channels and loyalty strategy

Luxury brands need to adapt their sales strategy to changing consumer habits. Exclusive loyalty programmes, private shopping on WhatsApp or personalised online shopping experiences can help retain customers.

Expansion into new segments

More and more luxury brands are entering the travel and hospitality sector, offering their customers not only products but also exclusive experiences. Bulgari is developing a chain of luxury hotels and Louis Vuitton has opened its own restaurant. Such activities allow brands to build even stronger ties with their customers and increase customer engagement.

Regional differences in the luxury market

In 2025, the situation in individual luxury markets will be different. China, which has been one of the key growth markets for years, is experiencing economic difficulties, limiting consumer spending on luxury goods. In contrast, the US remains a key growth market, especially for premium brands. Japan and the Middle East are the markets that show the greatest potential for growth in the coming years.

Brands need to adapt their sales strategies to local preferences and trends, rather than taking a one-size-fits-all approach across markets.

Which luxury categories will survive the crisis?

Not all luxury segments will be equally immune to the coming changes. Jewellery and leather goods will remain the least susceptible to economic downturns, as consumers view them as an investment. The experience and wellness sector is also growing in popularity, with consumers increasingly spending money on luxury travel and exclusive services rather than more products.

Luxury clothing and footwear may see a weaker performance, particularly among aspirational customers who have been pushed out by price rises.

What will luxury of the future look like?

The future of luxury will belong to brands that can adapt to changing customer expectations. Key elements include:

- Personalisation and exclusivity - customers want to feel special.

- Transparency and sustainability - expect more transparency in production and ethics.

- Expanding into new segments - wellness, travel and hospitality.

- Use of new technologies - AI, digital concierge, virtual boutiques.

Luxury brands cannot rely solely on prestige and price. Customers expect authenticity, unique experiences and real value. The future belongs to those who will offer more than just a logo.

Subscribe to Fashion Editorial and stay up to date with the world of fashion!

Get the latest news from the world of fashion - trend analysis, exclusive reports and alerts on key industry events.

🎁 Gift for subscribers!.

No spam, only valuable content! We do not share your data with third parties. By subscribing, you agree with our Privacy Policy.

Add your first comment to this post